By Elisa Mazen, Michael Testorf, CFA, & Pawel Wroblewski, CFA

Holding Steady in a Value-Led MarketMarket Overview

International equities delivered mixed results in the third quarter as the unbridled optimism that lifted European markets earlier in the year began to fade. The benchmark MSCI (MSCI) EAFE Index rose a respectable 4.8%, led by Asian markets and Canada, while Europe Ex U.K. underperformed. The MSCI EAFE Small Cap Index increased 6.2%, while the MSCI Emerging Markets Index continued to outperform despite a flat U.S. dollar, to advance 10.6%, boosted by a 20.7% rally in China, which represents 30% of that benchmark.

The strong momentum in Europe in the first half of 2025 — sparked by easing monetary policy, increased fiscal spending and a weaker U.S. dollar — slowed in the third quarter. While inflation has been gradually declining, with a 2.2% reading in September, it remains above the European Central Bank’s 2% target, causing the central bank to signal its intention to pause after a 25-bps reduction in September and leaving its key interest rate at 1.75%. Second-quarter eurozone GDP grew by just 0.1% quarter over quarter, with Germany’s output flat, while industrial activity continued to contract.

In Asia, Japan continued its controlled normalization of monetary policy but has begun to deal with reinflation in its recovering services sector due to a tight labor market. Second-quarter GDP expanded modestly, boosted by tourism, while manufacturing activity remained restrained. Dealing with stubborn weakness in the real estate sector and sluggish consumer demand, the People’s Bank of China (‘PBOC’) cut two key lending rates in July. Chinese prices saw a mild recovery from near-deflation levels, while second-quarter GDP growth rose 5.2 % year over year due to infrastructure spending and exports. The economy also got a boost from technology spending.

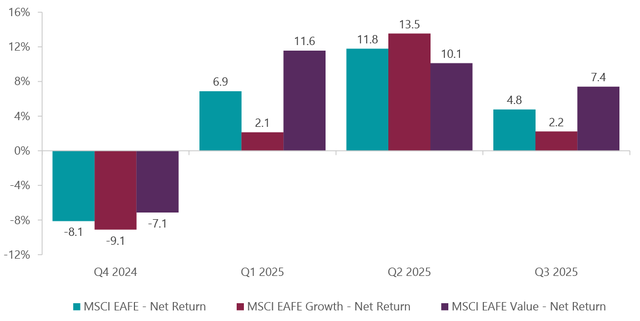

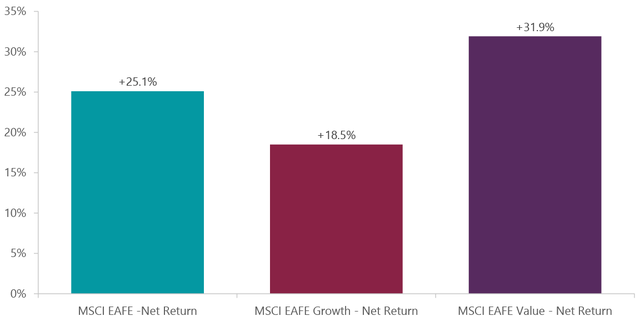

During a period of rising bond yields, international value stocks retook leadership from growth. The MSCI EAFE Value Index rose 7.4% in the quarter, outperforming the MSCI EAFE Growth (+2.2%) Index by over 500 basis points. Value leads growth by more than 1,300 bps year to date.

Exhibit 1: MSCI Growth vs. Value Quarterly Performance

As of September 30, 2025. Source: FactSet (FDS).

Exhibit 2: Growth Has Meaningfully Underperformed in 2025

As of September 30, 2025. Source: FactSet.

Performance Review

The ClearBridge International Growth Strategy kept pace with its core MSCI EAFE benchmark in the third quarter, with our sector positioning in information technology (IT) and financials, which reflects our orientation as growth managers, creating headwinds. The Strategy outperformed its secondary benchmark, the MSCI EAFE Growth Index.

The Strategy’s financials holdings caused the biggest drag on relative performance. London Stock Exchange (OTCPK:LDNXF), a position we have been steadily trimming, fell sharply due to concerns of AI threatening its desktop and data business. Dutch payments firm Adyen (OTCPK:ADYEY) was also down after quarterly revenue missed expectations on declining transaction volumes and management lowered its full-year revenue guidance. We have meaningfully repositioned our bank exposure over the past three months, adding three new positions (Banco Santander (SAN), HSBC (HSBC) and KBC Group (OTCPK:KBCSF)) while closing out of two others (BBVA (BBVA) and HDFC Bank (HDB)).

Banco Santander was bought with the proceeds of the BBVA sale. Spain-based Santander has a similar footprint as BBVA, but without the deal risk. The company is streamlining its geographic footprint and business lines from high-capital-consuming to low-capital-consuming operations. Santander’s cost-cutting measures should promote a sustainably lower cost/income ratio, which, combined with its other effects, should improve profitability.

HSBC has an outstanding franchise in Hong Kong and the U.K. and is well-placed to capture the structural growth opportunity in fast-growing Asian wealth management. HSBC benefits from a strong inflow of mainland Chinese money due to the larger investment opportunities and higher rates which the Hong Kong dollar enjoys through its peg with the U.S. dollar. We believe the market underestimates the company’s return potential, which is supported by one of the highest dividends and share buyback programs among global banks.

We also repurchased shares of KBC, a diversified banking and financial services provider catering to consumers and businesses in Belgium, the Czech Republic and smaller Eastern European markets. The company’s assets under management are growing and fee revenues are growing above net interest income. We believe its cross-selling model successful in Belgium can be replicated in other markets. KBC’s strong capital position also allows for capital distributions or a bolt-on acquisition.

Meanwhile, our thesis for Indian lender HDFC Bank has partly played out and we were close to our price target. Increased competition and slowing overall economic growth in India led us to sell the position in favor of higher-return candidates in the portfolio.

Weakness in several consumer discretionary names also weighed on relative results in the quarter. Latin e-commerce and fintech provider MercadoLibre (MELI) sold off as the company is extending its free shipping and reducing merchant fees. These initiatives, while potentially boosting volume, could weigh on near-term profitability. The company has also been hurt by profit taking after a strong first half and continues to deliver stellar revenue growth.

Chinese EV maker BYD (OTCPK:BYDDF) declined after cutting its domestic 2025 sales targets and reporting its first drop in monthly shipments in 18 months.

Offsetting these losses, the Strategy saw solid contributions in health care, led by European biotechs Argenx (ARGX)(OTCPK:ARGNF) and UCB. Health care has been a sector under pressure from the U.S. government tariffs and most favored nation pricing worries for much of the year. Argenx was lifted by robust sales of its Vyvgart autoimmune treatment and renewed confidence in its long-term pipeline. UCB (OTCPK:UCBJF) rose on robust first-half results, strong uptake of recently launched treatments Bimzelx for psoriasis and Rystiggo for an autoimmune condition, and positive phase 3 clinical trials for a seizure disorder. A Bimzelx competitor in an indication for an autoinflammatory skin condition has had less than compelling data, boosting UCB’s position in this disease area. Japanese medtech and technical equipment maker Hoya (HOCPF, HOCPY) also delivered strong performance, boosted by strength in its semiconductor business.

We expanded participation in an emerging Chinese biotechnology industry with the purchase of WuXi AppTec (WUXIF, WUXAY), a leading contract development and manufacturing organization for biotech companies. Wuxi AppTec has a track record of developing peptide and small molecule drugs with better efficiency and at much lower costs than competitors.

Portfolio Positioniong

Overall, the Strategy added 10 positions while exiting 13 others. In addition to our buys in financials and health care, our largest purchase was Prysmian, an Italian manufacturer of electric power transmission and telecommunications cables and systems. The electrification push expected over the next two decades will require a lot more high-voltage cables, triggering a step-change in the long-term growth of the power cables industry, with long-distance transmission and offshore wind being attractive markets for the company. In high voltage, Prysmian is 2x-3x larger than the next competitors in an oligopolistic market with only four players and high operating margins.

Japanese investment holding company Softbank (OTCPK:SFTBY) has an ownership stake in many technology companies — including chip maker ARM Holdings, a key developer of custom silicon for AI customers and offers exposure to privately held OpenAI — and trades at a meaningful discount to its NAV.

Canada’s Celestica (CLS) is a high-conviction AI infrastructure play, benefiting from hyperscaler capex growth, rising networking intensity and the shift toward white-box architectures. Its connectivity and cloud solutions segment is poised for 20%+ annual revenue growth, supported by deepening AI-related engagements and next-gen compute deployments. With accelerating earnings and margin expansion, we believe Celestica offers a differentiated, underappreciated way to gain exposure to the structural AI infrastructure buildout.

Also within the overall technology theme, we added to Tencent (OTCPK:TCEHY)(OTCPK:TCTZF) as its valuation has become attractive again. The Chinese conglomerate’s core gaming business is doing well on new game launches. Additionally, due to the nature of the reach of its content and data ecosystem on WeChat and other platforms, Tencent is well-placed to use AI solutions to accelerate growth via better user experience and advertising growth.

The Strategy closed out of Deutsche Telekom (OTCQX:DTEGF)(OTCQX:DTEGY) and food services provider Compass Group (OTCPK:CMPGF) in favor of ideas with less U.S. dollar exposure and greater upside potential. We also exited music streaming service Spotify (SPOT) and financial data provider Thomson Reuters (TRI) after both hit their price targets.

Outlook

The regions where we invest continue to make progress on growth and equity-friendly policies. While still early days, in the development of more stimulative economic and regulatory policies, and earnings growth among stocks in the pan European Stoxx 600 (STOXX) has begun to improve with forecasts for double-digit EPS growth over the next year.

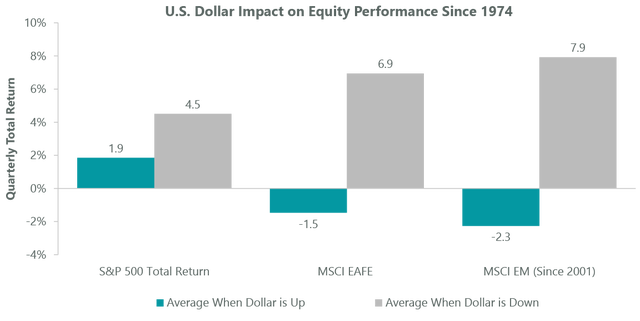

Broader macro trends, like a weakening U.S. dollar, are also shifting in favor of overseas companies. Emerging markets are taking the baton on the weak dollar and running with it, as evidenced by their outperformance versus developed markets in the third quarter. While our MSCI EAFE benchmark does not include emerging markets, we have maintained steady exposure to the asset class and have recently been expanding our EM weighting with a return to China.

Exhibit 3: A Sluggish Dollar Bodes Well for International Equities

| Data as of Sept. 30, 2025. MSCI EAFE and MSCI EM are net returns; MSCI EM data starts in 2001. Sources: FactSet, S&P, MSCI. Investors cannot invest directly in an index, and unmanaged index returns do not reflect any fees, expenses or sales charges. |

We believe that China, the world’s second-largest economy, is poised for growth due to its push to develop not only a standalone AI and technology universe but also a self-sufficient health care system. The latter priority has led to a burgeoning homegrown biotechnology industry. Meanwhile, its bellwether tech and Internet names have been gaining share in domestic consumer markets.

Portfolio Highlights

During the third quarter, the ClearBridge International Growth EAFE Strategy underperformed its MSCI EAFE Index benchmark. On an absolute basis, the Strategy produced positive contributions across all nine sectors in which it was invested (out of 11 total), with the industrials, health care and financials sectors the top contributors.

On a relative basis, overall stock selection contributed to performance but was offset by negative sector allocation effects. In particular, stock selection in financials, consumer discretionary and IT, an overweight to IT and underweight to financials weighed on results. On the positive side, stock selection in the health care, industrials, communication services and consumer staples sectors and an overweight to consumer discretionary contributed to performance.

On a regional basis, stock selection in emerging markets, North America and the U.K. and an underweight to Japan hurt performance while stock selection in Asia Ex Japan, Europe Ex U.K. and Japan and overweights to North America and emerging markets proved beneficial.

On an individual stock basis, the largest contributors to relative returns in the quarter were Fujikura (OTC:FKURF) in industrials, Argenx and UCB in health care, Tencent in communication services and Celestica in IT. The greatest detractors from relative returns included positions in SAP (SAP), Tokyo Electron (OTCPK:TOELF)(OTCPK:TOELY) and Constellation Software (OTCPK:CNSWF) in IT, RELX (RELX) in industrials and London Stock Exchange Group (LDNXF, LNSTY) in financials.

In addition to the transactions mentioned above, we initiated positions in Alcon (ALC) and Pro Medicus (PMCUF, PMDIY) in health care and Sony (SONY) Financial Group in financials. We also closed positions in BYD in consumer discretionary, Straumann (SAUHF, SAUHY) and Galderma Group (GDERF, GALDY) in health care, Sika (SXYAY, SKFOF) in materials as well as Bureau Veritas (BVRDF, BVVBY) and MonotaRO (MONOY, MONOF) in industrials.

Elisa Mazen, Managing Director, Head of Global Growth, Portfolio Manager

Michael Testorf, CFA, Managing Director, Portfolio Manager

Pawel Wroblewski, CFA, Managing Director, Portfolio Manager

|

Past performance is no guarantee of future results. Copyright © 2025 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance source: Internal. Benchmark source: Morgan Stanley (MS) Capital International. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance is preliminary and subject to change. Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent. Further distribution is prohibited. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here